Credit Wait Period

Your credit score and credit history are paramount factors when seeking a home loan. These metrics provide lenders with insights into your financial responsibility and ability to manage debt. A high credit score and positive credit history can result in more favorable loan terms, including lower interest rates and higher borrowing limits. Conversely, a low credit score or negative credit history may lead to higher interest rates or even loan denial. Understanding the impact of your credit on the homebuying process is crucial for making informed decisions and ensuring a smooth mortgage application.

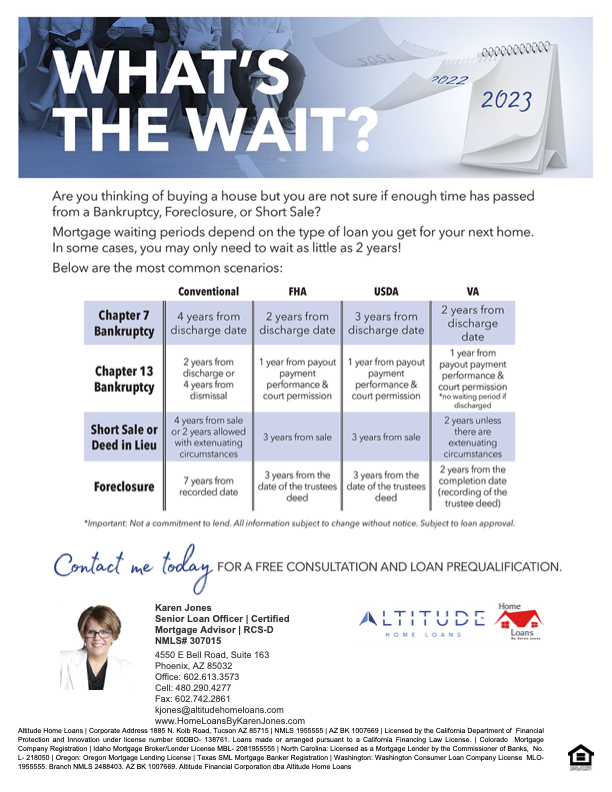

If you've faced financial challenges such as bankruptcy, foreclosure, or short sale in the past, it's essential to be aware of the waiting periods required before you can qualify for a new home loan. Our "What's the Wait?" flyer provides detailed information tailored to different program types, helping you navigate these waiting periods and plan effectively for your future homeownership goals.